Starbucks Q3 Print Largely Disappoints Even As CEO Pitches ‘A Wave Of Innovation In 2026’ — Retail Isn’t Convinced Yet

The results, which showed some pockets of improvement, such as growth in the China business, cast doubt over the company’s turnaround efforts.

Starbucks’ (SBUX) quarterly report on Tuesday largely disappointed, deepening concerns around its turnaround efforts, even as CEO Brian Niccol used the better part of the post-earnings call to detail future plans, including unleashing “a wave of innovation in 2026.”

Same sales dropped 2% in the fiscal third quarter, deaccelerating for the sixth straight quarter, compared to analysts’ expectation of a 1.19% drop from LSEG/Reuters. Adjusted earnings were $0.50 per share, also below the $0.65 estimate.

Starbucks’ net revenue rose 3.8% to $9.46 billion, beating analysts’ estimate of $9.31 billion, with an improvement in China helping offset persisting weakness in the home market.

Comparable store sales in China rose 2%, rebounding from flat growth in the previous quarter. Same-store sales in North America, Starbucks’ largest market, declined 2%, the same as in the second quarter.

Starbucks, which recently reduced prices in China, faces intense competition from local chains such as Luckin Coffee (LKNCY) and Cotti Coffee. It is also currently in talks to sell a partial or complete stake in its China operations.

SBUX shares bounced over 4% in aftermarket trading, although retail investors’ confidence remained suppressed.

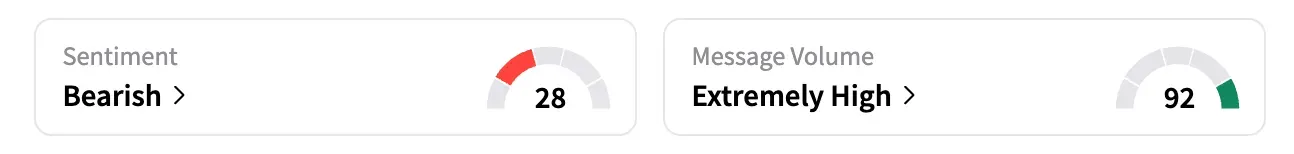

On Stocktwits, the retail sentiment shifted to ‘bearish’ as of late Tuesday, from ‘bullish’ the previous day. Message volume rose over 1,000% in the past 24-hour period, with SBUX featuring among the top 10 trending tickers on the platform.

A user remarked: “$SBUX This is like being in the movie ‘The Big Short’. You know it’s going to die, but can you hold on long enough.”

“$SBUX the pop makes no sense,” a user said, referring to the stock’s aftermarket move.

Turnaround Efforts

Niccol, who took over as CEO about 10 months ago, said the turnaround efforts were “ahead of expectations.” He detailed plans to further improve the store experience with “greater texture, warmth and layered design,” adding more seating, and increasing the number of service staff to provide a better customer experience.

Starbucks is also piloting a new, lower-cost “coffee house of the future” design, featuring 32 seats and a drive-thru opening in 2026, along with a small-format version that will debut soon in New York City.

Since taking over, Niccol has implemented several changes, including job cuts, a revamp of the cafes and menu items, and advising staff to come to the office four days a week.

Those plans have won the confidence of some Wall Street analysts, such as Jefferies, which recently upgraded its rating; however, the majority remain on the fence. Just under half of the analysts covering the stock, or 16, have a ‘hold’ rating, and two have a ‘sell’ rating, according to Koyfin data.

As of their last close, Starbucks shares are up 1.2%, compared to the 8.4% gain in SPDR S&P 500 ETF (SPY), which tracks S&P 500 stocks.

The best trade ideas and analysis from the Stocktwits community. Delivered daily by 8 pm ET.

For updates and corrections, email newsroom[at]stocktwits[dot]com.